In the annals of economic history, few events are as bizarre as the Toenail Clipping Bubble of 1623. This little-known episode from the bustling markets of 17th-century Venice holds uncanny parallels to the modern-day saga of Bitcoin. Strap in as we explore cautionary tale and glean valuable lessons for today’s crypto investors

The Birth of a Bizarre Market

It all began innocently enough. In the early 1600s, Venetian nobles, always on the lookout for the next peculiar trend, started exchanging toenail clippings as a token of camaraderie. What began as an odd social quirk quickly spiraled into a full-blown economic phenomenon.

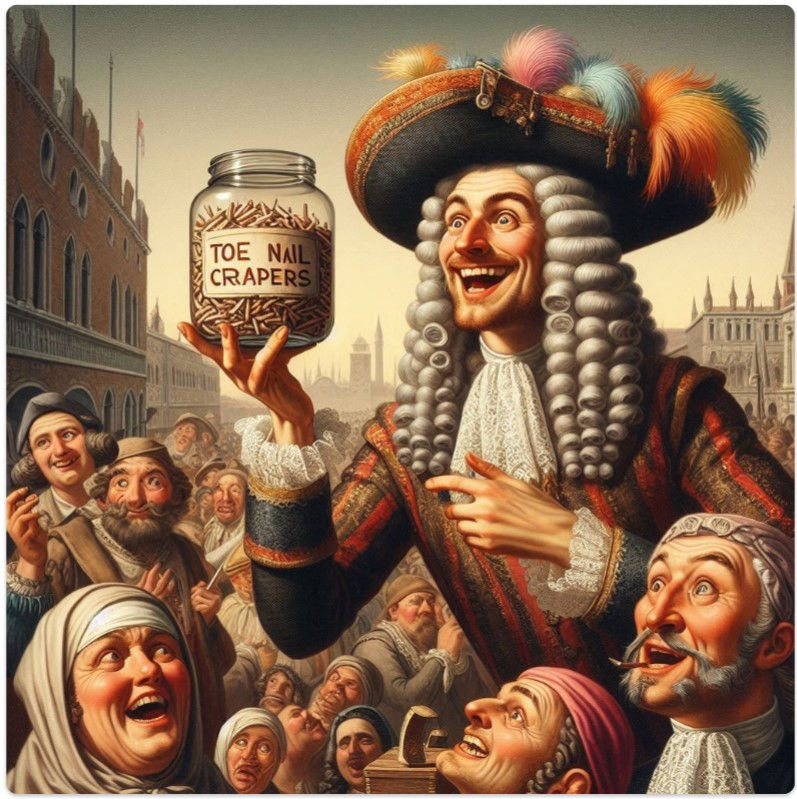

Much like Bitcoin’s mysterious origins with the enigmatic Satoshi Nakamoto, the initial spark of the toenail clipping craze is shrouded in mystery. Some say it started with Count Fabrizio Di Zoccolo, who famously gifted a jar of his finest clippings to Doge Giovanni I Cornaro as a gesture of goodwill. The Doge, not wanting to appear impolite, reciprocated with his own trimmings, and thus, a market was born.

The Rise of the Clipping Market

Word of the Doge's exchange spread like wildfire through the Venetian nobility. Soon, everyone from merchants to artisans began trading toenail clippings. A particularly well-preserved clipping from a prominent noble could fetch an astronomical price.

Marketplaces were abuzz with traders shouting, "Buy low, clip high!" and "Get your fresh cuttings here!" People began to see toenail clippings as a symbol of status and wealth. Just like Bitcoin miners, professional clippers emerged, offering their finely manicured specimens to the highest bidder.

The Clipping Bubble Peaks

As the market grew, so did speculation. People mortgaged their homes to buy clippings, hoping to sell them at a higher price. The toenail clipping market reached its peak in the summer of 1623, with clippings from the Doge himself being valued more than their weight in gold.

Enterprising Venetians even created toenail clipping futures, betting on the growth rate of noble toenails. Sound familiar, Bitcoin investors? It’s a classic case of hype and FOMO (Fear Of Missing Out), centuries before the term was coined.

The Pop: Reality Sets In

But, as with all bubbles, the toenail clipping craze was bound to pop. The end came swiftly and brutally. A scandal erupted when it was discovered that some traders were selling counterfeit clippings made from chicken bones. Trust in the market evaporated overnight.

Prices plummeted, and what was once considered a valuable asset became worthless. Noblemen who had invested heavily in clippings were ruined, their jars of toenails now a pungent reminder of their folly. The great Toenail Clipping Bubble had burst, leaving behind a trail of financial devastation and a valuable lesson for future generations.

Lessons for Bitcoin Enthusiasts

Intrinsic Value Matters: Toenail clippings had no real intrinsic value, much like the criticism often leveled at Bitcoin. While Bitcoin offers technological innovation, its value is still subject to collective belief. Don’t invest in something just because it’s trendy.

Beware of Hype: The Venetians were swept up in the hype of toenail clippings, just as many are with Bitcoin. Always do your own research and understand what you’re investing in. FOMO is a dangerous guide.

Diversify Your Investments: Many Venetians put all their wealth into toenail clippings and lost everything. Diversification is key. Don’t put all your eggs—or clippings—in one basket.

Scams Are Everywhere: The counterfeit clipping scandal shows that where there’s money, there will be fraud. Cryptocurrency is no different, with numerous scams and hacks. Be vigilant and cautious.

Market Cycles Are Inevitable: Every market experiences booms and busts. Understanding this can help temper expectations and encourage long-term thinking rather than short-term speculation.

Conclusion

The Toenail Clipping Bubble of 1623 may seem like a ridiculous footnote in history, but its lessons are timeless. As we navigate the volatile waters of Bitcoin and other cryptocurrencies, let’s remember the folly of those Venetian nobles. After all, those who forget the past are doomed to repeat it—even if that past involves toenail clippings.

Commentaires